Reading Time: 27 minutes

Cheapest states to retire in aren’t just about cutting costs—they’re about securing a comfortable and fulfilling lifestyle. Indeed, the best states for retirement on a budget offer low housing costs, affordable healthcare, and tax-friendly policies. This is where you enjoy your golden years without financial stress.

If you’re looking for the cheapest states to retire in, you’re making a smart move toward stretching your savings while maintaining a high quality of life. Retirement shouldn’t mean sacrificing comfort. It should be about finding a place where low-cost living meets strong community connections and essential services.

At Nationwide Auto Transportation, we know that relocating for retirement is about more than just choosing a destination. Whether you’re heading to a low-cost retirement state with warm weather or an affordable mountain town, we make moving easy with our professional car shipping services.

In this guide, we explore the top 5 most affordable states to retire in 2025, considering housing costs, healthcare, taxes, and overall affordability. If you’re ready to move to a state that maximizes your retirement savings, we’ve got the information you need—and the transportation solutions to get you there.

Need to relocate your vehicle? Get a free, hassle-free quote today!

The Nationwide Guide to the Cheapest States to Retire in 2025

Economic Shifts & Retirement Planning

The cheapest states to retire in aren’t just about savings—they’re about finding financial freedom without sacrificing quality of life. As we move further into 2025, economic shifts post-pandemic have made many retirees reconsider their financial strategies.

Inflation, interest rate fluctuations, and the rising cost of healthcare have pushed many to find affordable retirement states that provide low-cost living while offering a comfortable lifestyle.

Navigating this new landscape is crucial, especially for those looking to stretch their retirement savings. Whether you’re thinking about retiring in a tax-friendly state like Mississippi or a beautiful, affordable state like Oklahoma, it’s essential to choose a location that allows you to live comfortably without worrying about finances.

At Nationwide Auto Transportation, we understand the challenges of transitioning to a more affordable lifestyle. We make it easy for retirees to relocate their vehicles and settle into the cheapest states to retire in—so you can focus on enjoying your retirement!

🚗 Get a FREE car shipping quote today!

Retirement in 2025 | Key Considerations

When selecting the cheapest states to retire in, several factors need to be considered:

- Cost of Living Adjustments: Inflation and rising costs are important factors when deciding where to retire. For retirees on a fixed income, it’s vital to choose a state where your dollar stretches further. Don’t sacrifice essential services or quality of life.

- Healthcare Costs: Access to affordable healthcare is a priority in retirement. Consider states that offer good healthcare facilities and Medicare options for retirees.

- Tax Considerations: States like Mississippi and Alabama stand out for their tax-friendly policies that allow retirees to keep more of their money. No state income tax on Social Security and low property taxes are just a few benefits retirees can take advantage of.

- Strategic Retirement Planning:

- According to the AARP, a comfortable retirement typically requires about 80% of your pre-retirement income.

- Diversifying income streams make for a more secure retirement.

Key Considerations for Retirement in 2025 | Best State to Retire in

When planning your retirement, affordability is key, so is the overall quality of life. It’s not just about choosing the cheapest states to retire in. It is also about finding places where your dollar stretches without compromising on your lifestyle, healthcare, and personal well-being. Here’s what to keep in mind:

Considerations for Retirement

Early Savings | It’s Never Too Late to Start

Even if you’re nearing retirement, it’s never too late to start saving! Whether through 401(k)s, IRAs, or personal savings, contributing regularly to your retirement fund can help ease financial stress in your golden years.

Relying on Social Security

A substantial portion of retirees will rely heavily on Social Security benefits. Make sure you understand your benefits and how to maximize them. Visit the Social Security Administration website for detailed information on eligibility and benefits.

🔗 Get more tips on car shipping and retirement relocation on our blog. Whether you’re shipping your car, RV, or boat, we can help you move without a hitch!

If there is one thing that we can all be sure of, it is that everything is getting more expensive. Obviously that includes going on retirement.

ANONYMOUS

💰 Cost of Living | The 5 Biggest Retirement Expenses

| Expense Category | Why It Matters | Key Considerations for Retirees | Helpful Resources |

|---|---|---|---|

| 🏠 Housing Costs | The largest expense for most retirees. | – Affordable home prices and rent rates. – Low property taxes. – Senior property tax exemptions. | Senior Property Tax Exemptions by State |

| 🏥 Healthcare Costs | Medical expenses typically increase with age. | – Access to affordable, high-quality healthcare. – Strong Medicare benefits. – Proximity to quality hospitals. | Medicare.gov – Find Providers |

| 🛒 Groceries & Essentials | Day-to-day expenses can quickly add up. | – Lower grocery costs in certain states. – Sales tax exemptions on groceries in some areas. – Affordable prices for household items. | Sales Tax Rates by State |

| 💡 Utilities & Energy | Heating and cooling bills affect your monthly budget. | – Lower heating bills in warmer states (like Alabama & Mississippi). – Mild climates reduce both heating and cooling costs. | Energy Assistance Programs for Seniors |

| 🚗 Transportation | Staying mobile is key to independence. | – Low gas prices. – Reduced registration fees for seniors. – Access to affordable public transportation. | AAA – Senior Driving Resources |

Pro Tip: Look for states that offer senior discounts on utilities, property taxes, and transportation fees to stretch your retirement budget even further!

Tax Benefits for Retirees | Maximizing Your Savings

Even an affordable state can become expensive if taxes eat into your retirement income. Consider these key tax factors:

🚫 Income Tax | Keeping More of Your Money

- Some states don’t tax retirement income at all (pensions, Social Security, and 401(k) withdrawals).

- Tax-friendly states like Mississippi, Alabama, and Tennessee allow retirees to keep more of their money.

🏡 Property Taxes | Finding Low-Tax States

- Property taxes vary widely—some states offer tax exemptions for retirees, making homeownership more affordable.

- States like Alabama and Arkansas have some of the lowest property taxes in the nation.

🛍️ Sales Taxes | Saving on Everyday Purchases

- Some states don’t tax groceries, medications, or essential items, helping retirees stretch their budgets.

- Oklahoma and West Virginia have relatively low sales tax rates compared to other states.

How to Protect Your Retirement | Cheapest State to Retire in the United States

Did you know that most baby boomers don’t have any savings for their retirement, and that 40% will have to rely on Social Security for an income? That is why the search for the cheapest states to retire in has become a matter of urgency for many Americans who are reaching retirement age.

Retirement — How Can you Put Your Mind at Ease? | Adapt to Economic Changes

As the economic landscape evolves, so should your retirement planning strategy. Regularly reviewing and adjusting your plan can have you prepared for what lies ahead.

For further reading on adapting to these changes and optimizing your retirement savings, visit this comprehensive guide by the Census Bureau on who has retirement funds.

Bring these considerations into your retirement planning. It will help you better navigate the financial challenges and opportunities that come with retiring in today’s dynamic environment.

Time to Travel to The Cheapest Place to Retire in the United States

- Travel — You have extra free time, use it to travel and see the country. You can even fly to your destination, while your car gets shipped by a reputable auto carrier like Nationwide Auto Transportation.

- Snowbirds follow the sun, and if they do not own homes in different states, they either rent a home for the winter or summer, or stay in an RV. Find out about Snowbird Car Shipping and how Nationwide Auto Transportation can assist snowbirds, and other senior citizens who need to ship their vehicles.

In the sections below we consider what makes a place ‘cheap’ to live, and we identify the 5 cheapest states to retire in. The article also peeks at factors that include the average price of a house, the cost of living index, and Medicare costs.

Why Move to Cheapest States to Retire?

Rising real estate prices, hiked up interest rates, and soaring gas prices make the cheapest states to retire on social security a desirable move for many Americans. However, how do you know what is the least expensive state to retire in?

In this guide Nationwide Auto Transportation helps to give you a clearer picture of where are the best (and cheapest) places to retire in the US.

Where are the Cheapest States to Retire in the United States?

It makes sense that before we discuss where the cheapest places to buy land and retire in the United States are, we give an explanation of the meaning of ‘cheapest’ in the question, “Where is the cheapest place to retire in the country?”

Cheapest State to Retire In | Stretch Your Dollar

Guess which state lets your retirement savings stretch the farthest? With the national average cost of living indexed at 100, values below this indicate a cheaper cost of living, and values above it are more expensive. Understanding how your city stacks up in terms of daily expenses, housing, rentals, and transportation costs is vital when planning your retirement.

The cheapest states to retire in typically offer affordable housing and overall lower living costs compared to others. If you’re curious about how different states compare, the Council for Community and Economic Research provides reliable cost of living comparisons between your retirement location and other cities across the country. Currently, Mississippi holds the title for the cheapest state to retire in the United States. They offer retirees a chance to maximize their budget, and enjoy a comfortable lifestyle.

Cheapest Places to Retire | How can Retired Americans Fight Inflation?

Where is the safest, cheapest place to retire when you are trying your best to get away from the effects of inflation? This article highlights a few of our top choices, and you will see that the cost of living varies between states. This means that where you chose to retire could save, or cost, you a stack of bills.

Besides picking the cheapest places to retire in the Western United States, retirees or those nearing retirement can take additional steps to preserve their hard-earned money in challenging economic times.

Firstly, consider downsizing your living space to reduce maintenance costs and utility bills.

Secondly, explore low-cost hobbies and community activities to stay engaged without overspending. Additionally, review your healthcare options to find plans that offer the best value for your needs.

Furthermore, investing in energy-efficient appliances can lower monthly expenses over time. Finally, seek advice from a financial planner to optimize your retirement savings and income strategies, ensuring your finances are as resilient as your spirit in retirement.

Keep it Balanced in the Best Place to Retire

Do your best to have a balanced financial portfolio – Keeping a mix of cash, bonds, stocks and other financial assets will go a long way to a stable retirement fund.

The average American that is looking at retirement wants to get the most out of his life’s earnings, and with work not being of geographical importance after retirement, you can choose to live practically anywhere that suits your vibe… and budget of course!

| NATIONWIDE Pro Tip: Nationwide Auto Transportation has a series of “Moving to” articles, blog posts and guides that are extremely helpful when you want to look for the best places to live in the US, and the cheapest states to retire in the US. Get a FREE QUOTE while you are thinking about it too! |

Finding Your Ideal Retirement | More Than Just Affordability

Retirement: a new chapter filled with possibilities. But where will you write this chapter? Choosing from the cheapest states to retire in isn’t just about cutting costs; it’s about crafting a lifestyle that aligns with your dreams. Whether you envision a serene countryside retreat or a vibrant city brimming with activities, the right location can significantly impact your retirement experience.

Are you looking for the most affordable states to retire? Maybe are you prioritizing specific amenities and lifestyle factors?

For many, the allure of low-cost retirement states is undeniable. Especially when living on a fixed income like Social Security. However, the “best” place to retire is subjective. Some prioritize proximity to family, while others seek warmer climates or robust healthcare systems.

This guide will help you navigate the complexities of finding the perfect retirement destination. It focuses on best states for retirement on a budget–while considering all aspects.

Key Factors to Consider When Choosing Your Retirement Location

When evaluating potential retirement locations, consider these essential characteristics:

- Age-Friendly Housing: Prioritize homes with features that support long-term independence.

- Reliable Transportation: Ensure access to good public transportation, especially as driving may become challenging. If you plan on driving your own vehicle, Nationwide Auto Transportation can assist with safe and affordable vehicle relocation. Get a free quote from our automated auto shipping calculator to estimate auto shipping costs.

- Accessible Healthcare: Proximity to quality healthcare facilities is crucial for managing health needs in retirement. Look for low-cost retirement destinations with great healthcare.

- Economic Stability: A strong local economy can provide part-time work opportunities and ensure your retirement savings stretch further.

- Affordability: Choose one of the inexpensive retirement states to maximize your retirement income. Especially if you are looking for the cheapest states to retire on Social Security.

- Climate and Lifestyle: Consider your preferred climate and lifestyle. Southern states offer warmth, but ensure you’re comfortable with the heat.

- Tax-Friendly Policies: Look for most tax-friendly states for retirees, including states with no income tax for retirees.

Enhancing Your Retirement Lifestyle in Affordable States

Choosing from the best affordable places to retire in the U.S. opens up a world of opportunities:

- Social Engagement: Find communities with ample opportunities for socializing and staying active.

- Support Services: Access to services that assist with chores and maintenance, ensuring a comfortable lifestyle.

- Family Proximity: Consider locations that allow you to stay close to children and grandchildren.

- Senior Amenities: Enjoy amenities tailored to seniors, such as golf courses, museums, and recreational activities.

- Safety and Security: Prioritize locations with low crime rates, especially when wanting the absolute cheapest states to retire in.

Are you ready to find the best budget-friendly states for seniors and where to retire on a fixed income? Explore our list of the top low-cost retirement states to find your ideal retirement haven.

Simplify your move with Dependable Vehicle Shipping | Your Trusted Guide. Navigate your vehicle transport needs with expert advice and reliable solutions, perfect for your retirement relocation.

What are the Cheapest States to Retire in Right Now?

Where does Montana fall in cheapest states/places to retire? Unfortunately, although relatively kind to pensioners, the Cost of Living Index Report says it is not in the top 10 states to retire in the United States. However, we have put together a short list of alternative cheapest states to retire in to help you choose the best state to retire in for you.

🏆 The 5 Cheapest States to Retire in 2025 | State Spotlights

Finding the cheapest states to retire in means looking beyond just low costs—it’s about securing financial stability, tax advantages, and a fulfilling lifestyle. Based on the latest cost of living data, tax policies, and retirement benefits, here are the top five most affordable states for retirement in 2025.

Ready for the cheapest states to retire in this year? For retirees wanting affordable retirement locations without compromising on lifestyle, certain states consistently rise to the top. Based on the latest cost of living data and tax benefits, we’ve compiled a spotlight on the top 5 cheapest states to retire in for 2025.

These low-cost retirement states offer a compelling combination of financial advantages and appealing quality of life factors. From the southern charm of Mississippi to the mountain beauty of West Virginia, let’s explore each of these best states for retirement on a budget in detail.

#1 Mississippi | Lowest Cost of Living, Enticing Tax Benefits, and Southern Charm

Why Mississippi is #1 for Budget-Conscious Retirees

Mississippi stands out as the most affordable state to retire in 2025, offering the lowest cost of living in the nation. With affordable housing, no tax on retirement income, and low property taxes, retirees can stretch their savings while enjoying a relaxed Southern lifestyle.

✅ Lowest cost of living index in the U.S.

No state income tax on Social Security, pensions, or 401(k)s

✅ Mild winters, rich culture, and welcoming communities

Affordable housing and low property taxes

Updated Cost of Living Breakdown for Mississippi

(All indexes are based on the national average of 100. Lower numbers indicate lower costs.)

| Expense Category | Mississippi Index | National Average |

| Overall Cost of Living | 85.3 | 100 |

| Housing Costs | 68.6 | 100 |

| Grocery Costs | 97.1 | 100 |

| Utility Costs | 86.1 | 100 |

| Transportation Costs | 88.6 | 100 |

| Healthcare Costs | 97.6 | 100 |

📌 What this means for retirees: Mississippi’s housing costs are remarkably low, over 30% below the national average. This translates to significant savings for retirees, allowing you to allocate your budget to travel, hobbies, or other retirement pursuits. Whether you choose to buy or rent, your housing dollar goes much further in Mississippi.

Key Tax Advantages for Retirees in Mississippi

Mississippi is one of the most tax-friendly states for retirees. Here’s why:

✅ No tax on Social Security benefits

No state income tax on pensions, 401(k), IRA withdrawals

✅ Low property taxes (one of the lowest in the U.S.)

No estate or inheritance tax

This makes Mississippi an excellent choice for retirees who want to maximize their savings while reducing tax burdens.

Lifestyle and Community Highlights

Mississippi isn’t just affordable—it’s also rich in culture, nature, and history. Retirees here enjoy:

- Warm, mild winters – Ideal for avoiding harsh snow and high heating bills.

- Southern hospitality & strong sense of community – Perfect for those looking for a welcoming, small-town atmosphere.

- Gulf Coast beauty – Affordable coastal living in cities like Biloxi & Gulfport.

- Outdoor activities – Golf, fishing, and scenic countryside to explore in the best states for retirement on a budget.

- Low cost of entertainment & dining – Stretch your retirement budget while enjoying local experiences in most affordable states to retire.

Little-Known Fact:

Did you know that Mississippi played a crucial role in the development of the American trucking industry? Mississippi was home to Parker Brothers, who in the early 20th century, revolutionized the transportation of cotton with their innovative truck designs.

This pioneering spirit in transportation continues today. In fact, Mississippi has well-established logistics and infrastructure. Highly beneficial when relocating and shipping your vehicle with a company like Nationwide Auto Transportation!

Ready to explore the unbeatable affordability of Mississippi for your retirement? Considering a move to Mississippi?

Get a free car shipping quote from Nationwide Auto Transportation and start planning your move to the Magnolia State today!

#2 Oklahoma | Exceptionally Affordable Housing and Low Healthcare Costs

Why Oklahoma Offers Great Value for Retirees

Oklahoma ranks as one of the cheapest states to retire in due to its exceptionally low housing costs and affordable healthcare. With a cost of living 14% lower than the national average, retirees can enjoy a comfortable lifestyle without financial stress.

✅ Housing costs nearly 32% below the U.S. average

Low healthcare costs, ranking among the lowest in the nation

✅ Retirement-friendly tax policies

Mild climate with four distinct seasons

Updated Cost of Living Breakdown for Oklahoma

| Expense Category | Oklahoma Index | National Average |

| Overall Cost of Living | 86.0 | 100 |

| Housing Costs | 68.0 | 100 |

| Grocery Costs | 93.8 | 100 |

| Utility Costs | 92.3 | 100 |

| Transportation Costs | 91.5 | 100 |

| Healthcare Costs | 91.8 | 100 |

📌 What this means for retirees: Oklahoma’s housing costs are remarkably affordable, nearly 32% below the U.S. average. This significant saving on housing allows retirees to free up their budget for other priorities, such as travel, recreation, or healthcare expenses in this low-cost retirement state.

Key Tax Advantages for Retirees in Oklahoma

Oklahoma is considered one of the most tax-friendly states for retirees, offering several advantages that make it one of the best states for retirement on a budget:

✅ No state tax on Social Security benefits

$10,000 deduction on other retirement income (401(k), IRA, pensions, etc.)

✅ Relatively low property taxes (average rate of 0.90%, well below the national average)

No estate or inheritance tax

Oklahoma does have a state income tax (ranging from 0.25% to 4.75%), and a moderate sales tax. However, its overall tax burden remains low. Especially when considering the significant retirement income deduction and lack of Social Security tax in this inexpensive retirement state.

Lifestyle and Community Highlights

Oklahoma offers more than just affordability—it provides a high quality of life with strong community ties and rich cultural heritage. This is why it’s one of the best affordable places to retire in the U.S.:

- Low-cost outdoor activities – Hiking, fishing, and boating in scenic locations like the Wichita Mountains.

- Friendly small towns and vibrant cities – Options ranging from Tulsa and Oklahoma City to charming retirement-friendly towns in budget-friendly states for seniors

- Mild winters with four seasons – Enjoy warm summers and mild winters without extreme temperature swings.

- Rich arts and music scene – From cowboy culture to jazz history, Oklahoma is full of cultural attractions.

- Strong sense of community – A welcoming atmosphere with a low cost of entertainment and dining in one of the most affordable states to retire.

Little-Known Fact About Car Shipping in Oklahoma

Oklahoma is home to one of the longest stretches of historic Route 66, making it a key hub for cross-country vehicle transportation. Many auto transport companies use Oklahoma’s central location and major highways (I-35, I-40, and I-44) as a transit point for cost-effective car shipping.

📌 Need to move your car to Oklahoma? Nationwide Auto Transportation offers safe and reliable vehicle shipping for retirees relocating to the state.

Get a FREE car shipping quote today!

🔗 Helpful Resources

- Official Oklahoma State Website: Oklahoma.gov

- Internal Link: Best States for Snowbirds – Ideal for seasonal retirees moving between warm and cold climates.

- External Link: SmartAsset – Oklahoma Retirement Taxes – Understand Oklahoma’s tax benefits for retirees.

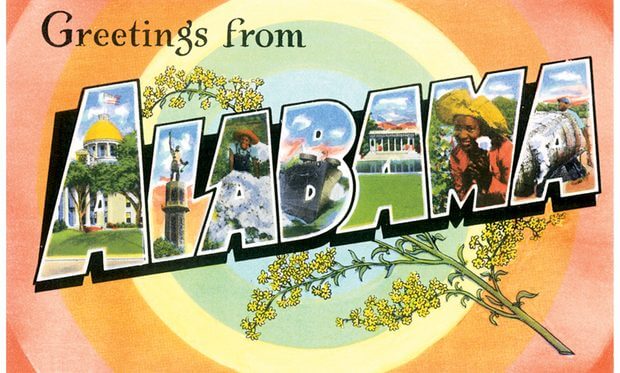

#3 Alabama | Tax-Friendly Policies and a Mild, Welcoming Climate

Why Alabama Remains a Top Choice for Affordable Retirement

Alabama consistently ranks among the cheapest states to retire in. This is thanks to its incredibly tax-friendly policies and overall low cost of living. Retirees wanting affordable retirement locations, with a warm climate and welcoming communities, will find Alabama exceptionally appealing.

With a cost of living nearly 12% lower than the national average, Alabama lets you enjoy a comfortable retirement without stretching your budget.

✅ Housing costs significantly below the U.S. average

Very low property taxes, maximizing homeownership affordability in low-cost retirement states

✅ Retiree-friendly tax policies, especially on Social Security

Mild climate with warm winters, ideal for snowbirds seeking inexpensive retirement states

Updated Cost of Living Breakdown for Alabama

| Expense Category | Alabama Index | National Average |

| Overall Cost of Living | 88.8 | 100 |

| Housing Costs | 70.4 | 100 |

| Grocery Costs | 96.4 | 100 |

| Utility Costs | 103.6 | 100 |

| Transportation Costs | 96.2 | 100 |

| Healthcare Costs | 86.9 | 100 |

📌 What this means for retirees: Alabama’s remarkably low housing costs and very low property taxes combine to make homeownership exceptionally affordable. This allows retirees to significantly reduce their monthly housing expenses and build long-term financial security in one of the cheapest states to retire in.

Key Tax Advantages for Retirees in Alabama

Alabama is recognized as one of the most tax-friendly states for retirees in the U.S., offering several key benefits that make it a retirement tax-friendly state::

- No state income tax on Social Security benefits

- Significant exemptions on other retirement income: While Alabama does tax some forms of retirement income, it offers a generous deduction of up to $3,000 per taxpayer for those 65 and older, effectively reducing the tax burden on pensions, 401(k)s, and IRAs in affordable retirement locations.

- Very Low Property Taxes: Alabama boasts some of the lowest property taxes in the United States, further enhancing affordability in best affordable places to retire in the U.S.

- No inheritance tax

Alabama has a state income tax (ranging from 2% to 5%) and a state sales tax of 4%. That said, the overall tax burden for retirees remains very favorable. Especially considering the exemptions and deductions available.

Lifestyle and Community Highlights

Alabama offers a relaxed and appealing lifestyle that extends beyond just affordability:

🏝 Warm climate and outdoor recreation: Enjoy mild winters, long springs and falls, and access to the Gulf Coast beaches, forests, and lakes for year-round outdoor activities in inexpensive retirement states.

🏡Charming Southern towns and cities: Explore historic towns like Fairhope and Mentone, or enjoy the larger city amenities of Huntsville and Mobile.

🗝Rich cultural heritage: From the Civil Rights Trail to vibrant music scenes and delicious Southern cuisine, Alabama offers a rich cultural experience in affordable retirement locations.

😃Friendly communities and Southern hospitality: Experience the welcoming atmosphere and strong community spirit of the South in low-cost retirement states.

🚗 Little-Known Fact About Car Shipping in Alabama

Alabama has a surprisingly robust automotive manufacturing industry, home to major plants for Mercedes-Benz, Honda, Hyundai, and Toyota!

This automotive presence means Alabama is a key state for auto transport logistics. Established routes and experienced car shipping carriers frequently moving vehicles in and out of the state allows this. Relocating to Alabama? You’ll be moving to a state that understands car transportation!

📌 Need to move your car to Alabama? Nationwide Auto Transportation provides dependable and budget-friendly vehicle shipping services for retirees moving to Alabama.

🔗 Helpful Resources

- Official Alabama State Website: Alabama.gov

- Internal Link:

- For assistance with relocating your vehicle to Alabama, consider Nationwide Auto Transportation’s services.

- For additional insights on tax-friendly retirement destinations, explore this resource: Kiplinger’s State-by-State Guide to Taxes on Retirees

#4 Arkansas | Natural Beauty, Outdoor Recreation, and Low Property Taxes

Why Arkansas Appeals to Nature-Loving Retirees on a Budget

How does Arkansas, “The Natural State,” secure its place among the cheapest states to retire in? Easy, by offering a compelling blend of scenic beauty and affordable retirement locations.

For retirees wanting low-cost retirement states, where outdoor recreation and natural landscapes are readily accessible, Arkansas provides exceptional value. More so, as one of the best states for retirement on a budget.

The state has a cost of living nearly 10% below the national average! With that, Arkansas allows you to enjoy an active retirement amidst stunning scenery without overspending. Come home to one of the most affordable states to retire.

✅ Low property taxes, making homeownership attainable

Abundant natural beauty and outdoor recreational opportunities

✅ Overall cost of living significantly below the U.S. average

Friendly communities with a relaxed pace of life in budget-friendly states for seniors

Updated Cost of Living Breakdown for Arkansas

| Expense Category | Arkansas Index | National Average |

| Overall Cost of Living | 90.3 | 100 |

| Housing Costs | 76.3 | 100 |

| Grocery Costs | 95.4 | 100 |

| Utility Costs | 92.2 | 100 |

| Transportation Costs | 99.1 | 100 |

| Healthcare Costs | 87.2 | 100 |

📌 What this means for retirees: Arkansas’s low property taxes and affordable housing market create a welcoming environment for retirees seeking homeownership. Lower housing costs in this cheapest state to retire in can free up significant funds. Enjoy the state’s natural beauty and pursue an active, outdoors-oriented retirement lifestyle.

Key Tax Advantages for Retirees in Arkansas

Arkansas offers a moderately tax-friendly environment for retirees, with some notable advantages that make it a retirement tax-friendly state.

Partial exemption on retirement income: While Arkansas does tax retirement income, it offers a significant $6,000 annual exemption for retirement income, including pensions, annuities, and IRA distributions. This can reduce your state income tax liability.

✅ No state tax on Social Security benefits

Low property taxes: Arkansas boasts some of the lowest property taxes in the United States, especially in rural areas, making it one of the best affordable places to retire in the U.S.

✅ No inheritance tax

Arkansas has a state income tax with rates ranging from 2% to 4.9% and a state sales tax of 6.5%. However, the retirement income exemption and low property taxes help offset these, making it one of the best states for retirement on a budget.

🏡 Lifestyle and Community Highlights

Arkansas offers a unique lifestyle that appeals to nature lovers and those seeking a relaxed pace of life:

✅ Outdoor paradise: Explore the Ozark and Ouachita Mountains, numerous lakes and rivers. Traverse national forests, with endless opportunities for hiking, fishing, boating, and camping in affordable retirement locations.

✅ Hot Springs National Park. Enjoy thermal springs, historic bathhouses, and beautiful mountain scenery. A visit to this unique national park within one of the most affordable states to retire is a must.

Friendly small towns and welcoming communities: Experience the charm of small-town living with friendly locals and a strong sense of community in budget-friendly states for seniors.

✅ Affordable entertainment and dining: Enjoy lower costs for restaurants, cultural events, and local attractions.

🚗 Little-Known Fact About Car Shipping in Arkansas

While Arkansas is known for its natural beauty, it also has a surprising connection to transportation history! The Butterfield Overland Mail route, a pioneering cross-country stagecoach service in the mid-1800s, ran through Arkansas. It established key transportation corridors that are still relevant for vehicle shipping and logistics today with companies like Nationwide Auto Transportation.

📌 Planning your move to enjoy the natural beauty of Arkansas? Nationwide Auto Transportation offers reliable and affordable vehicle shipping services to help retirees relocate to the Natural State.

Get a FREE car shipping quote today! Nationwide Auto Transportation Car Shipping Quote Calculator

🔗 Helpful Resources

- Official Arkansas State Website: Arkansas

- Internal Link: Moving to the best states to retire in! Benefits and Considerations – Learn more about the benefits of rural living, which Arkansas offers in abundance.

- External Link: Kiplinger – State-by-State Guide to Taxes on Retirees in 2024: Arkansas – Explore Arkansas’s retiree tax benefits in detail from Kiplinger.

#5 West Virginia | The Mountain State | Affordable Mountain Living and Rich History

Why West Virginia Offers a Unique and Inexpensive Retirement Option

West Virginia, known as “The Mountain State,” rounds out our list of cheapest states to retire in. Offering a unique appeal for retirees looking for affordable retirement locations amidst stunning mountain scenery and a strong sense of community.

If you dream of low-cost retirement states with a distinct Appalachian charm and access to outdoor adventures, West Virginia is a state to explore. Boasting a cost of living that is nearly 10% below the national average, West Virginia allows you to embrace a simpler, more affordable lifestyle in a beautiful setting.

✅ Very affordable cost of living, especially for housing ✅ Beautiful mountain scenery and outdoor recreation opportunities ✅ Strong sense of community and small-town charm ✅ Rich history and cultural heritage

Updated Cost of Living Breakdown for West Virginia

| Expense Category | West Virginia Index | National Average |

| Overall Cost of Living | 90.3 | 100 |

| Housing Costs | 70.9 | 100 |

| Grocery Costs | 97.7 | 100 |

| Utility Costs | 97.8 | 100 |

| Transportation Costs | 99 | 100 |

| Healthcare Costs | 97 | 100 |

📌 What this means for retirees: West Virginia’s housing costs are particularly attractive. It allows retirees to find affordable homes and apartments in scenic mountain towns and communities.

Key Tax Advantages for Retirees in West Virginia

West Virginia provides a moderately tax-friendly environment for retirees with some key benefits:

✅ Social Security benefits are exempt from state income tax

✅ Retirement income exclusion: Retirees can exclude a portion of their retirement income from state income tax. While not a full exemption, this exclusion can reduce your tax liability.

✅ Reasonable property taxes: Property taxes in West Virginia are generally lower than the national average.

✅ No inheritance tax

West Virginia has a state income tax with rates ranging from 2.36% to 5.12% and a state sales tax of 6%. While not as dramatically tax-advantaged as some other states on this list, the low cost of living, especially for housing, makes West Virginia one of the best states for retirement on a budget.

🏡 Lifestyle and Community Highlights

West Virginia offers a unique lifestyle that appeals to those seeking natural beauty and a close-knit community:

✅ Outdoor Adventure Paradise: The Appalachian Mountains dominate West Virginia, offering world-class hiking, white-water rafting, skiing, and breathtaking scenic drives in affordable retirement locations. ✅ Rich History and Culture: Explore historic towns, coal mining heritage sites, and a vibrant tradition of Appalachian music and crafts. ✅ Small-town charm and friendly locals: Experience the warmth of small-town living and strong community bonds in budget-friendly states for seniors. ✅ Four distinct seasons: Enjoy the beauty of all four seasons, with colorful fall foliage, snowy winters, and pleasant springs and summers.

Little-Known Fact About Car Shipping in West Virginia

West Virginia is home to the historic National Road, also known as the Cumberland Road. This was one of the first major improved highways in the United States, authorized in 1806. While predating modern car shipping, this road played a vital role in early westward expansion and transportation. It highlights West Virginia’s historical significance in American travel and movement. A legacy that connects to modern vehicle relocation with Nationwide Auto Transportation today!

🔗 Helpful Resources

- Official West Virginia State Website: WV.gov

- Internal Link: Snowbird Car Shipping: Your Guide to Seasonal Vehicle Relocation – Perfect for retirees considering seasonal moves to and from West Virginia’s varied climate.

- External Link: Annuity Expert – West Virginia Retirement Taxes – Get detailed information on West Virginia’s tax advantages for retirees.

West Virginia Auto Transport | Safe and Reliable Car Shipping

Looking to relocate to West Virginia or need your vehicle shipped safely and efficiently? At Nationwide Auto Transportation, we understand the importance of reliable car shipping. Especially when moving to a state as unique as West Virginia — surrounded by the Appalachian Mountains and home to the breathtaking Monongahela National Forest.

🔒 Protect Yourself from Car Shipping Scams

When shipping your car — whether it’s from Phoenix, AZ to Richmond, VA or Cleveland, OH to Virginia Beach, VA — choose a trusted auto carrier. Here’s how to spot a legitimate company:

✅ Payment Methods: Beware of companies that request wire transfers. A reputable transporter will offer secure payment options like credit cards.

✅ License & Registration: Legitimate companies are regulated by the FMCSA (Federal Motor Carrier Safety Administration). They have a valid Motor Carrier (MC) Number. Don’t hesitate to ask for this!

✅ Website Credibility: Check the company’s website. Look for a professional design, detailed service pages, and customer reviews. Poor grammar, broken links, and lack of contact info can be red flags.

Popular West Virginia Auto Transport Routes

Our reliable car shipping services cover major routes to and from West Virginia. Whether you’re moving or simply transporting your car, we’ve got you covered:

- Phoenix, AZ to Richmond, VA: Car Shipping Quote

- Cleveland, OH to Virginia Beach, VA: Auto Shipping Service

- Nashville, TN to Virginia Beach, VA: A+ Auto Shipping

- Dallas, TX to Virginia Beach, VA: Express Car Shipping

- St. Louis, MO to Virginia Beach, VA: Affordable Car Shipping

- Norfolk, VA Auto Transport: Learn More

Plan Your West Virginia Move with Confidence

Don’t let car shipping scams ruin your retirement or relocation plans. Trust Nationwide Auto Transportation for safe, affordable, and reliable auto transport services across West Virginia and beyond.

➡️ Ready to ship your car? Get a free quote and let us handle the journey: West Virginia Car Shipping

Other Affordable Retirement States to Consider

After looking at West Virginia, there are several other budget-friendly states that make for excellent retirement destinations. Here’s a glimpse at a few more top picks that combine affordability with a high quality of life:

Alabama

With a cost of living 13% below the national average, Alabama is a fantastic option for retirees seeking affordability.

The state offers low property taxes, no income tax on Social Security, and great weather.

Whether you enjoy golfing or exploring the Gulf Coast, Alabama is a retirement-friendly state that should not be overlooked.

👉 Learn more about moving to Alabama

Georgia

If southern hospitality and beautiful beaches are what you’re after, Georgia offers just that with low living costs and great tax benefits for retirees. The state exempts Social Security from taxes and provides exemptions for retirement income. Georgia’s mild climate and abundance of retirement communities make it a top choice.

👉 Learn more about moving to Georgia

Idaho

For outdoor lovers, Idaho is a hidden gem offering low taxes, low property costs, and the stunning Scenic Idaho. With a 5% lower cost of living than the US average, Idaho offers the perfect mix of affordability and access to nature.

👉 Learn more about moving to Idaho

#South Carolina

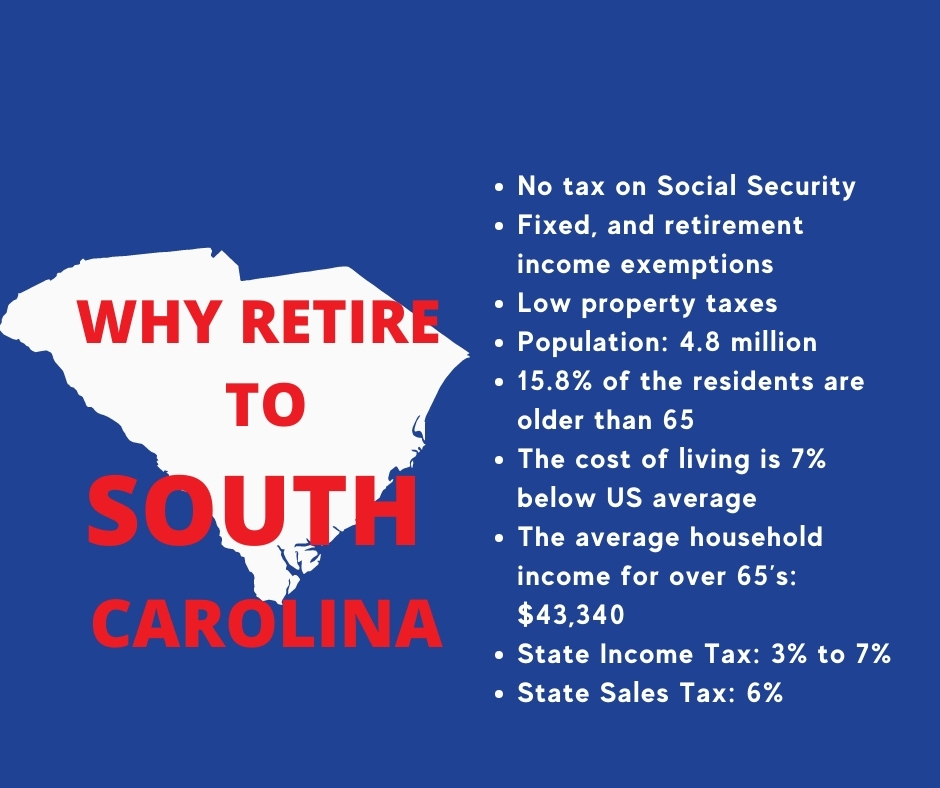

Can you see yourself living around outstanding classic golf courses, in close proximity to iconic beautiful beaches, and always surrounded by nature’s splendor? Yes? Well, South Carolina should be on your list of cheapest states to retire in the United States.

The Palmetto State, and its abundance of affordable retirement communities, becomes even more desirable for retirees when you take into account the low cost of living, below average property taxes, and open-handed retirement and fixed income exemptions.

Why Retire in South Carolina?

Although Sales Tax in South Carolina tends to be higher than in most other states, exemptions and tax rebates for retirees are good enough so that the state ranks high on the list of cheapest states to retire in the US. In short, South Carolina offers retirees:

- No tax on Social Security

- Fixed, and retirement income exemptions

- Low property taxes

South Carolina—The Facts and Figures | cheapest state to retire in

- Population: 4.8 million

- 15.8% of the residents are older than 65

- The cost of living is 7% below US average

- The average household income for over 65’s: $43,340

- State Income Tax: 3% to 7%

- State Sales Tax: 6%

Before we conclude which state has the lowest cost of living for retirees, did you know that the cheapest state to retire for military personnel is Mississippi? It also happens to not only be one of the best places to stay in the US, it is also the cheapest place to retire in the country.

Visit the Nationwide Auto Transportation website to learn how they assist military employees to move all over the country.

What you need to know about moving to South Carolina

Are you Ready to Move to the Cheapest States to Retire in

Our unwavering commitment to safety and service excellence is underscored by our longstanding affiliation with the Federal Motor Carrier Safety Association and our positive reviews on the Better Business Bureau website. Partner with us for this exciting chapter of your life.

Moving to Your Retirement State | A Smooth Transition with Nationwide Auto Transportation

Retirement is an exciting new chapter, and relocating to an affordable state is a great way to see that your golden years are financially stress-free. As you plan your move, finding the right retirement home and community is just as important as securing affordable housing.

But no matter where you choose to live, Nationwide Auto Transportation is here to provide reliable car shipping services that make your transition seamless.

Finding the Right Retirement Home and Community

When choosing a state to retire in, consider both affordability and quality of life. Whether you prefer coastal living in Alabama, a mountain retreat in West Virginia, or an outdoor paradise in Idaho, you’ll want your new community to offer the amenities and social support you need.

- Access to healthcare is a priority. You’ll need reliable and affordable options as you age.

- Community engagement: connect with other retirees.

- Proximity to family and friends can also play a big role in your decision.

Nationwide Auto Transportation | Reliable Car Shipping for Your Relocation

At Nationwide Auto Transportation, we understand that moving can be stressful, but shipping your car doesn’t have to be. Whether you’re relocating from Florida to Tennessee, Texas to West Virginia, or anywhere in between, we offer safe, secure, and affordable car shipping services tailored to your needs.

- Free, no-obligation car shipping quotes

- Experienced and professional auto carriers nationwide

- Fast and easy car shipping process that fits your schedule

Start your new life in your dream retirement state without worrying about how to get your vehicle there!

👉 Get a free quote now and let us handle the rest!

Nationwide Services for Every Need

Whether it’s Car Shipping, RV Shipping, Boat Shipping, or Heavy Duty Shipping, we offer a variety of services tailored to meet your specific requirements. Explore how we can make your retirement move seamless and worry-free.

Don’t just take our word for it; our customer reviews and testimonials speak volumes of our dedication to excellence. At Nationwide Auto Transportation, we’re more than a service—we’re your partner in transitioning to a fulfilling retirement.

Get 20% OFF Car Shipping

If you’re in the process of moving cars, consider Nationwide Auto Transportation. We offer safe and reliable car shipping services across the country. Rely on our team to find the best solution for your unique needs.

Check out our car shipping quote calculator and get 20% OFF your first shipment.

FAQ | Best and Cheapest States to Retire in the USA

Q1: What are the best states to retire in for 2024?

A1: The best states to retire in offer a blend of affordability, healthcare, and quality of life. For 2024, states like Alabama, Missouri, and Georgia are considered top choices due to their low cost of living and tax advantages for retirees. It’s also worth considering states like Tennessee and Iowa, known for their friendly communities and scenic beauty. Check out the complete list on our Best States to Retire guide.

Q2: Which states are the most affordable to retire in?

A2: When it comes to affordability, the most budget-friendly states for retirees include Mississippi, with its remarkably low cost of living index, and Alabama, known for its tax benefits and low healthcare costs. Kansas and Nebraska also make the list with their overall lower living expenses. Learn more about affordable living in these states on our Cheapest States to Retire page.

Q3: How can I find out the cheapest places to retire in the United States?

A3: To find the cheapest places to retire, consider states where the cost of living is below the national average, like Arkansas and West Virginia. These states offer affordable housing and healthcare, which are crucial for retirees on a fixed income. For a detailed comparison, visit the Council for Community and Economic Research for up-to-date cost of living indexes.

Q4: What factors should I consider when choosing a state to retire in?

A4: When choosing a state to retire in, consider the following factors:

- Cost of Living: Ensure everyday expenses are manageable on your retirement budget.

- Tax Benefits: Look for states with favorable tax structures for retirees.

- Healthcare: Access to quality healthcare is vital as you age.

- Lifestyle: Find a state that matches your desired retirement lifestyle, whether it’s leisure activities or proximity to family. For more information on what to expect, visit the Federal Motor Carrier Safety Association for insights into relocating in your retirement years.

Q5: Where can I find reliable reviews for auto transportation services for retirees?

A5: For reliable reviews on auto transportation services tailored for retirees, visit Nationwide Auto Transportation’s Reviews page and Testimonials section. These resources offer insights from customers who’ve experienced our services firsthand, helping you make an informed decision for your vehicle shipping needs.

Discover More About Retirement Living

Navigating the wealth of information available about retirement living can be daunting. To assist you in making informed decisions, we’ve curated a list of resources that provide valuable insights and guidance:

- AARP Retirement Guide: A comprehensive resource for planning, covering financial advice, lifestyle tips, and much more.

- Medicare.gov: The official U.S. government site for Medicare provides information on healthcare options for retirees.

- Social Security Administration: Understand your Social Security benefits and how they fit into your retirement plan.

- National Council on Aging: A wealth of resources to help improve the lives of older adults with practical solutions and services.

- SmartAsset Retirement Calculator: An intuitive calculator to help you project your retirement savings and plan financially.

Each of these sites is a fantastic starting point for delving deeper into what retirement could look like for you.

Frequently Asked Questions (FAQ) About Retiring in Cheap States

Which state offers the lowest taxes for retirees in 2025?

States like Mississippi, Alabama, and Tennessee are known for their tax-friendly policies for retirees, with no state income tax on Social Security benefits and low property taxes.

What are the best states to retire in on a Social Security income?

West Virginia, Georgia, and Florida provide affordable living costs and favorable tax conditions for retirees living on a fixed income from Social Security.

How much money do I need to retire comfortably in these states?

Generally, retirees in cheapest states can live comfortably on about 80% of their pre-retirement income. However, living costs can vary significantly depending on your lifestyle, healthcare needs, and housing preferences.

What if affordability isn’t my only priority?

If you value quality of life alongside affordability, states like Georgia and South Carolina offer a great balance of low living costs, access to outdoor activities, and strong community support.

How can Nationwide Auto Transportation help with my move?

We specialize in car shipping services that make your move easy. Whether you’re relocating a car, RV, or boat, we offer customized shipping solutions designed for retirees.